Top 5 Dividend Stocks Want To Pay You More

TheStreet.com's article 5 Big Dividend Stocks Want To Pay You More lists five large cap stocks that TheStreet.com believes are likely to increase their dividend payouts in the next few months. They are: CVS, GRMN, KO, PFE, and SLB.

You can read the article to find out their comments on each of those stocks (and why they like them) but their basic strategy was to find stocks with a solid balance sheet, low payout ratio, and a history of dividend hikes, with the goal being to create a list of companies that might raise their dividend in the next few months and that were appropriate to hold between now and then (or even longer).

Top Dividend Stocks

Their set of five companies includes some of the top dividend companies in America, when listed by market cap:

| Symbol | Market Cap | Annual Dividend | Yield |

|---|---|---|---|

| CVS | 104B | $1.10 | 1.20% |

| GRMN | 11B | $1.92 | 3.35% |

| KO | 194B | $1.22 | 2.72% |

| PFE | 196B | $1.04 | 3.34% |

| SLB | 119B | $1.60 | 1.86% |

GRMN is a bit of an outlier (based on market cap), and SLB had a huge 7% drop yesterday because of the OPEC decision not to cut output to firm up oil prices. (But the drop actually raises SLB's current dividend yield, since it's a percentage of stock price.) With the exception of GRMN these stocks would be appropriate for most conservative portfolios.

Increasing Yield

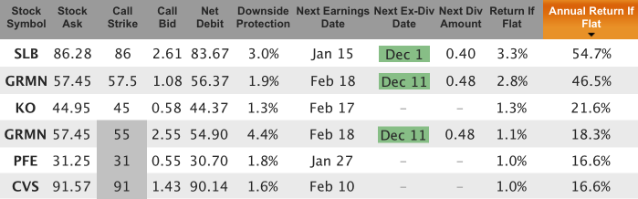

To earn more than just the dividend yield, let's look at some at-the-money covered calls for the Dec 20 expiration. We can earn some nice time premium while we wait for these companies to maybe increase their dividends:

Increasing Yield For 2 Months

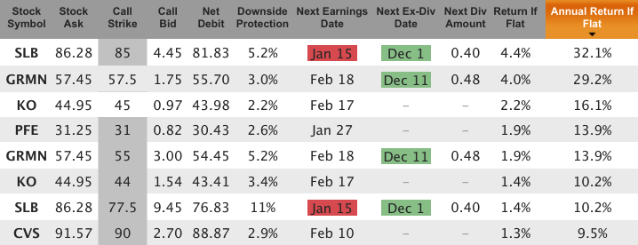

For a longer covered call, say 2 months until the January 17, 2015, expiration, here are some double-digit annualized yields:

The Jan SLB covered calls do cover an earnings release date, so beware of that. But if you're going to hold SLB for a quarter or more then there's no way to avoid that.

As always, don't take TheStreet.com's word for it that these are the top stocks for you. Do your own research, stay diversified, keep your positions reasonable, and make sure they are appropriate for your personal risk/reward profile.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.