Apple (AAPL) Trades January 2

Today's articles Apple Wins Christmas and Buy Shares Of Apple On Any Weakness (due to Wells Fargo downgrade), combined with Apple's below average PE and higher than average growth rate, make us think that 2014 could be another great year for weekly covered call writers in AAPL. Yes, there are concerns about its industry-leading margins coming down, but then there's also new revenue growth and profit from their recent deal with China Mobile. In the end, we believe that in-the-money options are a good way to earn premium this year.

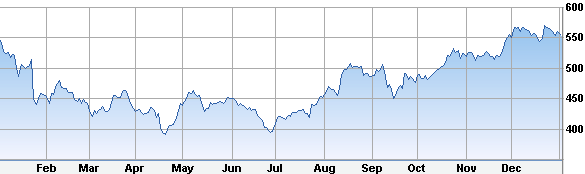

2013 Price Action

In 2013 AAPL was below $400 twice and ended up finishing the year where it began:

AAPL Stock Price in 2013

January Covered Calls On APPL

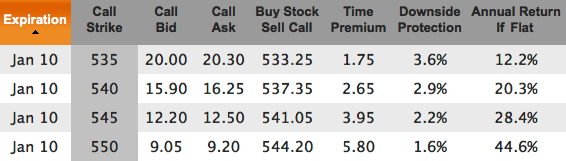

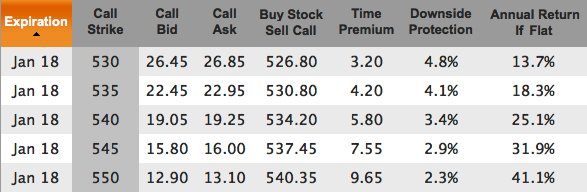

Currently AAPL is trading at 553.25 (down 7.77 for the day, when the market is down 150). Next earnings come out Jan 21 after the close, so there is one weekly option (Jan 10) and one monthly option (Jan 18) that are *not* subject to earnings volatility (we are ignoring tomorrow's Jan 3 weekly expiration since there is only 1 day left).

For weekly traders, in-the-money options for Jan 10 include everything from the 535s for the 1%/month crowd (>12%/year) to the 550s for the 3%/month crowd (>36%/year):

For monthly traders, the Jan 18 expiration offers the 530s (1%/month) to the 540s (2%/month) to the 550s (3%/month):

If you are bullish on AAPL and want to leave yourself some room for upside potential (capital gains) then you'd look at out-of-the-money strikes at 555 or higher. But remember earnings come out Jan 21 so keep that in mind when setting your expiration date. If you're really bullish you may want to sell options far out of the money (600 strike or higher) with an expiration date after Jan 21, or else leave your shares uncovered through earnings and then write some in the money options after earnings are announced.

There is no "best" answer to the question of which strike and expiration to use; it all depends on your risk profile and your personal beliefs about AAPL's future stock price.

Also, we recognize that owning 100 shares of AAPL is a $50K+ commitment and therefore out of reach for some investors. However, AAPL trades mini options (10 share contracts) so you can actually do these trades for around $5K of capital (buy 10 shares and sell 1 mini contract). Just be sure that you're trading at a low commission broker before trading minis.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.