More Weekly Options

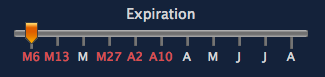

We are pleased to announce expanded coverage of weekly options in our covered call screener. We now show many weeks worth on the Expiration slider (weeklys are in red):

To see them, follow the instructions on How to enable screening for weekly options.

Increasing Number Of Weekly Options

The CBOE has been expanding the number of symbols that trade weekly options for years. Currently, there are over 400. Here are the number of symbols for each expiration date, and the number of unique call options (distinct strike price/symbol combination) for each date:

| Expiration Date | Type | # of stocks & ETFs | distinct call options |

|---|---|---|---|

| Mar 6, 2015 | weekly | 407 | 19,829 |

| Mar 13, 2015 | weekly | 406 | 19,336 |

| Mar 20, 2015 | monthly | 4250 | 74,927 |

| Mar 27, 2015 | weekly | 405 | 17,125 |

| Apr 2, 2015 | weekly | 405 | 16,186 |

| Apr 10, 2015 | weekly | 405 | 15,028 |

| Apr 17, 2015 | monthly | 4244 | 59,486 |

There are still about 10x as many symbols that trade monthly options compared to weeklys, but that gap is getting smaller all the time. It was just a few years ago when there were only 50 symbols that traded weeklys. They have become hugely popular.

Weekly Options Open Interest And Time Premium

To see if people are actually using weeklys, let's take a look at the sum of the open interest and time premium by expiration date. The open interest is the number of option contracts for that expiration date, across all symbols and strikes. The time premium is just the time premium portion of all the open contracts for that expiration date:

| Expiration Date | Sum of Open Interest | Sum of Time Premium |

|---|---|---|

| Mar 6, 2015 | 4,017,613 | 0 |

| Mar 13, 2015 | 2,138,275 | $72,188,728 |

| Mar 20, 2015 | 31,934,927 | $1,518,844,336 |

| Mar 27, 2015 | 1,070,746 | $66,274,931 |

| Apr 2, 2015 | 693,573 | $57,048,084 |

| Apr 10, 2015 | 261,709 | $20,933,845 |

| Apr 17, 2015 | 16,841,792 | $1,122,333,603 |

The time premium for the Mar 6 weeklys is zero because we're writing this article after the market closed on Mar 6, and all those weeklys are now at expiration.

But next week, Mar 13, has $72M of time premium when taken as a group (all of the weekly call options that expire on Mar 13). That's $72M that will decay to zero if all the 406 symbols remained unchanged between today and Mar 13. And there's over $1.5 billion of time premium in the Mar 20 options (as a group, does not include intrinsic value of any options).

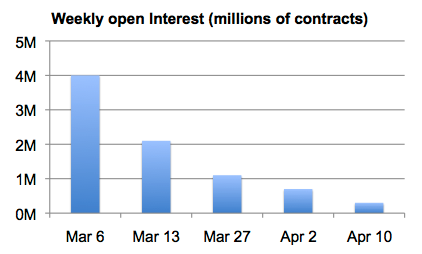

If we look at just the weekly open interest by expiration date (ignore monthlies) on a chart, we see that most of the interest is in the near week, with each subsequent week having about 1/2 of the open interest of each previous week:

Top Stocks For Next Week's Weeklys

There's no denying that weeklys are popular. You have to be careful, though, because not all symbols or strikes/expirations have sufficient open interest or volume. Low interest usually results in wide bid-ask spreads, which can increase your cost of getting in or out of a position (always use limit orders at the midpoint of the bid-ask as a starting point when placing orders).

The most popular, and therefore liquid, weekly options expiring next week, Mar 13, are:

| Symbol | Strike | Open Interest |

|---|---|---|

| BAC | 16.5 | 201,811 |

| SPY | 211 | 46,848 |

| BAC | 17 | 46,811 |

| SPY | 213.5 | 43,593 |

| C | 53 | 32,274 |

| BAC | 16 | 32,232 |

| SPY | 215 | 29,324 |

| BAC | 15.5 | 23,818 |

| JPM | 62 | 21,437 |

| SPY | 215.5 | 18,305 |

| SPY | 214 | 13,591 |

| AAPL | 130 | 13,548 |

| SPY | 212 | 13,289 |

| AXP | 82.5 | 12,963 |

| CVX | 111 | 12,317 |

| SPX | 2100 | 11,788 |

| AAPL | 128 | 11,772 |

SPY is always one of the top weeklys, so that's to be expected. And today's stress test results for the banks, combined with a job report that convinced investors that the Fed is likely to raise interest rates in June, bodes well for the banks (BAC, JPM). AAPL is going to introduce the iWatch next week, which is probably why it's on this list (although it is often on the list in the absence of news, too).

Screening For Weeklys

You can screen for weekly options using our software, see Screening For Weekly Options.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.