| April 1st? Already!? |

|

Yikes! Press deadline caught us off guard this April Fool's and we're sad to say we didn't have time to create a new joke this year. (And by "not enough time" I mean a giant radioactive iguana ate our joke, of course.)

If you think you're crushed, just imagine how we feel. Most years we love the April issue. Well, until next April you can take a look at a couple of our favorites... the Free Money Printing Press (we still get emails from people asking if the offer is still valid...) and the Money Making Guide. Enjoy, and beware of April Fool's today!

|

| Dividend Stocks For A Volatile Market |

|

Large cap dividend stocks offer relative stability in a volatile market. Companies that consistently grow earnings can not only protect their dividends, but they have the cash to fund annual dividend increases, too. Large cap dividend stocks offer relative stability in a volatile market. Companies that consistently grow earnings can not only protect their dividends, but they have the cash to fund annual dividend increases, too.

TheStreet.com chose 4 such dividend stocks, ranging in dividend yield from 2.8% to 4.7%. Their article states reasons why they chose those stocks but our article shows how to make those stocks yield even more via covered calls. We show 4 covered calls expiring Apr 17 with annualized returns of 28% or more. See Volatile Market Dividend Stocks.

|

| Best Stock Brokers for 2015 |

|

For the 20th year in a row, Barron's has published their reviews for the best stock brokers of the year. For the 20th year in a row, Barron's has published their reviews for the best stock brokers of the year.

This year was almost a 3-way tie, but Interactive Brokers won again, for the 4th year in a row. Check out how your broker ranks in terms of fees, fills, frills, and features in the Best Stock Brokers of 2015.

|

| More Weekly Options! |

|

Weeklys have come a long way since they were introduced in 2005. Today there are 408 underlying symbols (stocks and ETFs) that trade weeklys. They're popular because of the rapid time decay.

We've added expanded screening for weekly options. Now you can see up to 5 future weekly expirations at the same time, on the Expiration slider, the Chain page, and other places on the site where weeklys appear.

You can read about our expanded weekly coverage, including some interesting open interest stats, or check out the page on how to enable weeklys in your account.

|

| 27 Dividend Challengers |

|

The title Dividend Champion goes to companies that have increased their dividends for 25 years in a row or more. The up and comers, who have increased dividends for 5 years or more, are called Dividend Challengers.

For this list of 27 companies, 2015 marks the 5th year when they've raised dividends. They are the new Challengers.

There is another list of 27 companies farther down on that page that will become Challengers if they raise their dividend before June 9 (this with be their 5th year of increased dividend). The success rate of predicting dividend increases like this is about 90%. Most of these companies will raise their dividend in the next 60-70 days.

What can you do with that info? Well, one idea is to plug that second set of 27 symbols into Born To Sell's Watchlist feature and see if any of them make good covered call candidates, banking on the fact that any dividend increases in the next couple months are probably going to be good for the stocks.

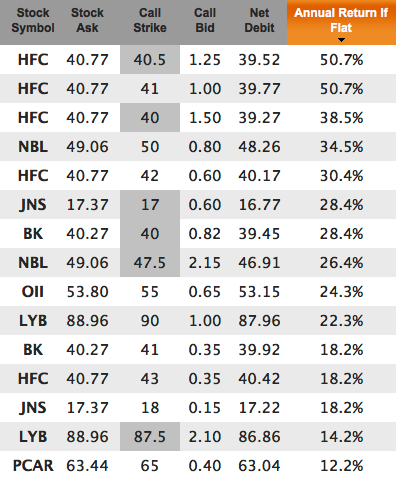

Ok... So we did that. Turns out the highest yielding covered calls for the Apr 17 expiration Dividend Challengers are:

And if you go out to the May 15 expiration, only NBL, LYB, TAXI, and PCAR offer annualized returns > 13%. These are not recommendations to buy, but just ideas as a starting point for your own diligence. Happy hunting.

|

| Guess The Dow Contest |

|

Thanks to everyone who participated in our Guess The Dow contest. Entries were closed on Mar 15 but winners won't be chosen until after the close on April 10 (a weekly option expiration date).

The median guess for the closing value of the DJIA on April 10 was 17,901. Stay tuned and good luck everyone! If you want to see the distribution of the guesses, check out the histogram of guesses.

|

| AAPL And 3 Other Covered Calls For Apr 17 Expiration |

|

With two and a half weeks to go until the April options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | AAPL | 125 |

| 2. | USO | 17 |

| 3. | NLNK | 50 |

| 4. | DOW | 50 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| AAPL And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | AAPL |

| 2. | MSFT |

| 3. | T |

| 4. | INTC |

| 5. | VZ |

| 6. | FB |

| 7. | CVX |

| 8. | CSCO |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|