Weekly vs Monthly

We get a lot of questions about weekly covered calls vs monthly covered calls. The basic question is: Which is best? And then, once duration has been established, the next question is usually about Moneyness: Which is best, in-the-money or out-of-the-money?

Everything Is Relative

Investors come a variety of flavors. Some are retired people just trying to earn more than what bonds or blue chip dividends pay (conservative style), while others are young people interested in high growth (aggressive style). And everything in between. In addition, some investors have large portfolios combined with a personal risk tolerance to accept large drawdowns. There is no universal "best"; it's relative to each investor's risk/reward profile and life circumstances.

How Popular Are Weekly Options?

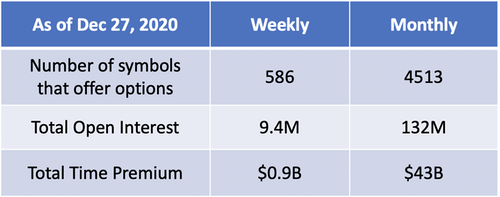

Here are today's stats on all outstanding call options:

There are about 14x more monthly call option contracts outstanding than weekly call option contracts (this is down from 35x a few years ago when we last looked at this; weeklys are at least 2x more popular now). That includes monthlies of all durations, including LEAPs. If you look at just the January monthly expiration then there are about 52M open call contracts, compared to 3.4M for the sum of the January weeklys. So the monthlies are more popular in aggregate.

The total amount of time premium (not including intrinsic value) for current call options is about $900 million for weeklys and $43 billion for monthlies. So a lot more money is riding on the monthlies, too.

Weeklys vs Monthlies

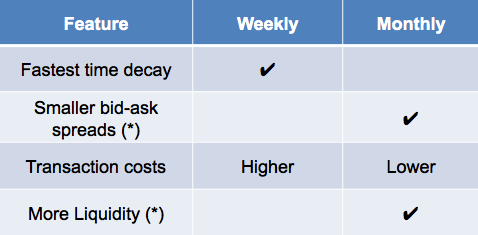

Here are some pros and cons of weeklys vs monthlies:

(*) These are conditional because some of the higher volume weeklys have similar bid-ask spreads and liquidity as their monthly counterparts. But the vast majority of weeklys have significantly wider spreads and lower liquidity than the average monthly option. Transaction costs are higher for weeklys because you will be trading more often if you trade weeklys vs monthlies.

Weekly Options With The Highest Open Interest

The top 10 underlying symbols when sorted by current weekly call option open interest are:

Because the above are high-volume weeklys you shouldn't have any trouble with wide bid-ask spreads or illiquidity.

More Time Decay In A Series Of Weeklys Than A Single Monthly

An option's time decay is not linear, resulting in the sum of 4 weekly option's time decay being higher than a single monthly's time decay. (See our two prior blog articles on non-linear time decay and how time premium is calculated.) However, during the final week of a monthly option's life it behaves just like a weekly (because when it has less than a week until expiration it is a weekly option), with the exception that because it started off life as a monthly option it probably has more open interest than your average weekly.

Moneyness Of Weeklys

Choosing a strike price for your covered call (see moneyness tutorial) is really up to personal preference and personal opinion on where the underlying stock price will be on expiration day. Weeklys are no different than monthlies in this regard.

If your style of covered call investing with monthlies is to write deep-in-the-money (DITM) then you'll probably do the same with weeklys. However, because there are only a handful of days until expiration, the amount of time premium in a DITM weekly is likely to be small. You may have to write slightly less DITM, or even at-the-money in order to have the time premium earned cover the transaction costs and still leave a profit that meets your goal.

And, just like monthlies, the highest time premium in a weekly series will be the at-the-money strike.

So Which Is Best?

Both weeklys and monthlies are appropriate for covered call investing. Weeklys give you more flexibility, like being able to invest 48 weeks out of the year (instead of only 8 months) if you want to avoid earnings risk for a particular stock, but most of them come with wider bid-ask spreads and lower liquidity, making them challenging to roll or exit early.

"Best" for one investor is not necessarily "best" for another investor. Depends on too many investor-specific variables to crown one better than another for the population at large.

If you'd like to screen for weekly covered calls, here's how to do it with our weekly option screener. Experiment with small position sizes and decide which is best for you.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.