TSLA Covered Calls

Everyone’s favorite stock-of-the-moment (unless you're short), TSLA. From just over $100/share in March to $660-ish 9 months later. Made some ordinary people millionaires, while some hedge fund shorts have lost billions. For the feint of heart, it is not.

Goldman Sachs has a 12-month price target of $780 while JP Morgan has a 12-month price target of $90. Neither firm is a slouch, so really no-one knows. There are forces at play here that few can understand or predict. Which is why we suggest you stay out if you’re not in, or cover (some or all) if you are in.

Open Interest In TSLA Is 1.3% Of The Market

Currently, market-wide there are 141M call option contracts open (the sum of open interest across all strikes, expiration dates, and underlying stocks). Of those, 1.8M are for TSLA, or about 1.3%. That’s a lot for a single stock, but only enough for 8th place in the list of weekly options with the highest open interest.

Time Premium In TSLA Is 13.4% Of The Market

But if you look at the amount of time premium, you see the out of the ordinary investment in TSLA. Out of the $43B in market-wide call option time premium that exists right now, $5.76B is in TSLA calls. Think about that… 13.4% of all call option time premium that exists right now is tied up in one stock that is not an index. That's amazing.

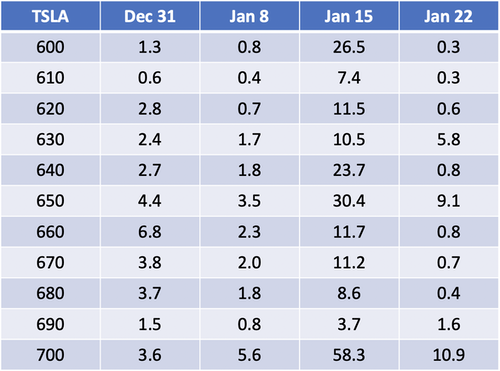

Broken down by strike and expiration, the sum of time premium (open interest * time premium per contract) for each is (in millions of $s):

First observation is that the monthly expiration date of Jan 15 is much more popular than any of the weekly dates. Second observation is that the 700 strike has the highest sum of time premium. People gravitate to round numbers.

Covered Calls On TSLA

Considering the rise from 100 to 660 over 9 months, this is a hard stock to do a buy-write on right now, unless you go really deep in the money. But even 10% ITM (let’s say 600 strike) could easily finish out of the money by any of the dates above. Heck, it was 92 points lower 3 weeks ago (568 on Dec 2).

Some of the recent rise was because of the stock’s inclusion into the SP500. That won’t be undone. Those index fund shares are now long-term holds and effectively removed from float. Some of the rise was because of a short squeeze where huge bets were made against the stock, and then covered. The current short position is around 45M shares, which is a lot but, given its daily trading volume, that’s only about 1 day to cover (not a lot). And lastly, some of the rise is due to momentum traders and algos riding the trend.

Who should write a covered call on TSLA?

While we can’t recommend a buy-write at this time (except for the most risk-loving among you) people who are long TSLA shares may want to write some calls as a way to (1) get a little defensive, (2) take some profits, and (3) use the funds from selling the calls to buy something else (NOT more TSLA; maybe buy some Bitcoin if you need more volatility in your portfolio).

Bullish on TSLA

Choice of strike is up to you, and with this stock you can argue for just about anything. Raging bulls may want to do a short-term Dec 31, 700-strike. That’s only 4 trading days away and offers 3.50 in time premium (about 0.5%), and leaves you with 40 points of upside potential over those 4 days.

Neutral on TSLA

Neutral TSLA investors (if there are any) may want to max the premium by writing a Jan 15, 660-strike to collect around 38 points of premium (5.7% in 3 weeks). Of course, that at-the-money strike will eliminate your upside. No more gains above 660 for you. Heck, you might be giving up 200 points of upside over the next 3 weeks (if the stock rises to 860 by then).

Bearish on TSLA

Conservative TSLA investors (there definitely aren’t any) or people who are already in the stock and want to take some off the table may want to cover (or partially cover) with an in-the-money covered call (or just sell the shares, there's nothing wrong with selling some or all after a 7x gain in 9 months). The 600-strike for Jan 15 offers 16 points of time premium, so if the stock closes at any price over 584 on Jan 15 you will make something (max 16 points, about 2.4%).

And if you really want to get in on a buy-write, and you’re a conservative investor, you can write the 450-strike for Jan 15 and still get 3.15 in time premium, for an annualized return around 11%. Of course, there are less volatile ways to make 11% annualized return (not involving TSLA stock).

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.