10 Best Stocks To Buy

InvestorPlace.com surveyed 10 finance experts and asked each of them to pick 1 stock to buy that they believe will outperform the market in 2015. The result is their list of 10 Best Stocks To Buy For 2015. The interesting thing about this list is that it was created by 10 different financial experts, with each one recommending only 1 idea for market-beating performance. Given their different strategies and outlooks, it's an eclectic list. Today, being a down day for the market, might be a good time to pick up some of these expected winners.

Best Stocks To Buy

Without further ado, here are the 10 best stocks to buy for 2015 (according to the experts):

| Symbol | Ask Price | Div | Yield | Sector |

|---|---|---|---|---|

| AAPL | 106.48 | 1.88 | 1.8% | Technology |

| ABM | 28.40 | 0.64 | 2.3% | Services |

| GOOG | 515.95 | - | - | Technology |

| GPRO | 66.91 | - | - | Consumer |

| IEZ | 47.98 | 0.94 | 2.0% | Energy |

| NE | 15.67 | 1.50 | 9.6% | Energy |

| ODFL | 75.74 | - | - | Transportation |

| PSEC | 8.36 | 1.33 | 15.9% | Financial |

| PZZI | 7.33 | - | - | Services |

| YHOO | 49.02 | - | - | Technology |

The reasons why the experts chose these stocks are described in the original article. But suffice it to say that these aren't shoot-from-the-hip picks; these are thoughtfully considered and researched choices. After all, the experts' reputations will be influenced by the performance of their picks a year from now.

Best Covered Calls For 2015

With the exception of PZZI, all of these stocks have options available and are therefore candidates for covered call writing. With the price of oil dropping to new 5-year lows today, and new concerns about Greece/Euro, now would be a good time to consider some in-the-money covered calls (where the strike price is below the current stock price) so that you can earn some premium but also have a bit more downside protection working for you.

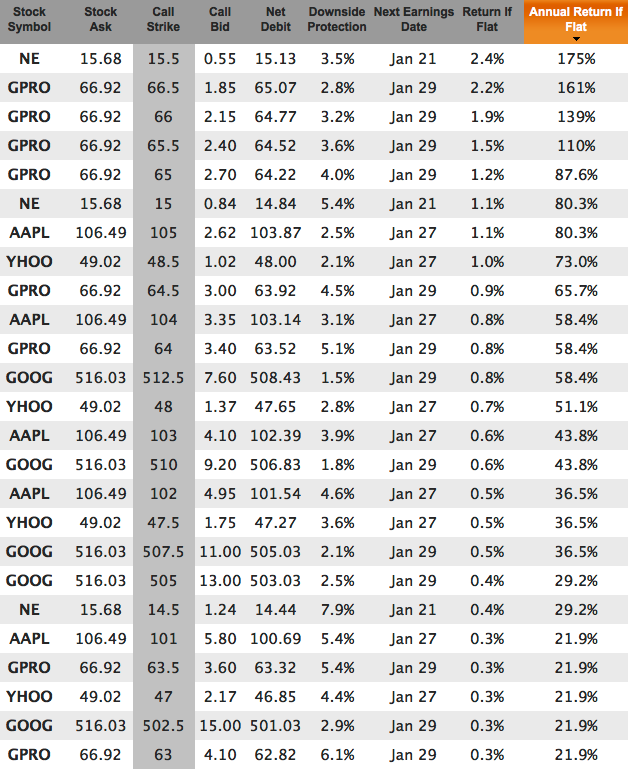

If you plug the 9 optionable stocks into Born To Sell's Watchlist feature and set it for in-the-money only, you find many combinations of strike prices and expiration dates that yield over 20% annualized rate of return for this Friday's (Jan 9th) expiration date, many of which have more than 5% downside protection (which is a lot for a 5-day trade), and all of which are in-the-money:

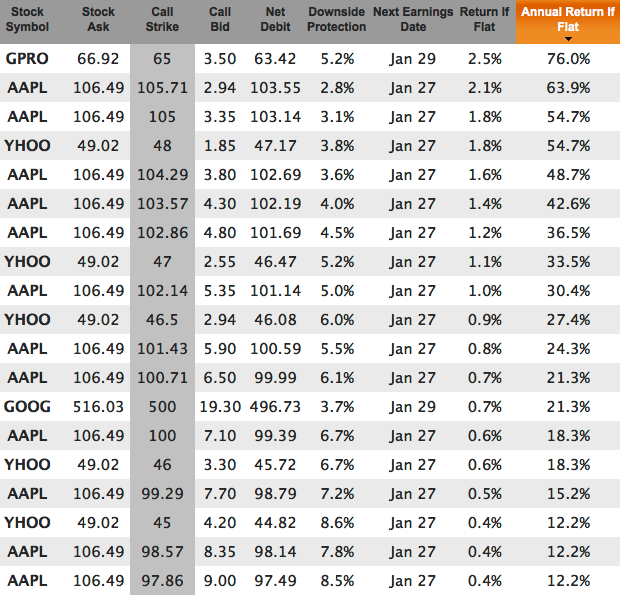

If we go out a week farther to the Jan 17 monthly expiration (a 12-day trade), there are many trades with an annualized rate of return > 12%, some of which have more than 8% downside protection:

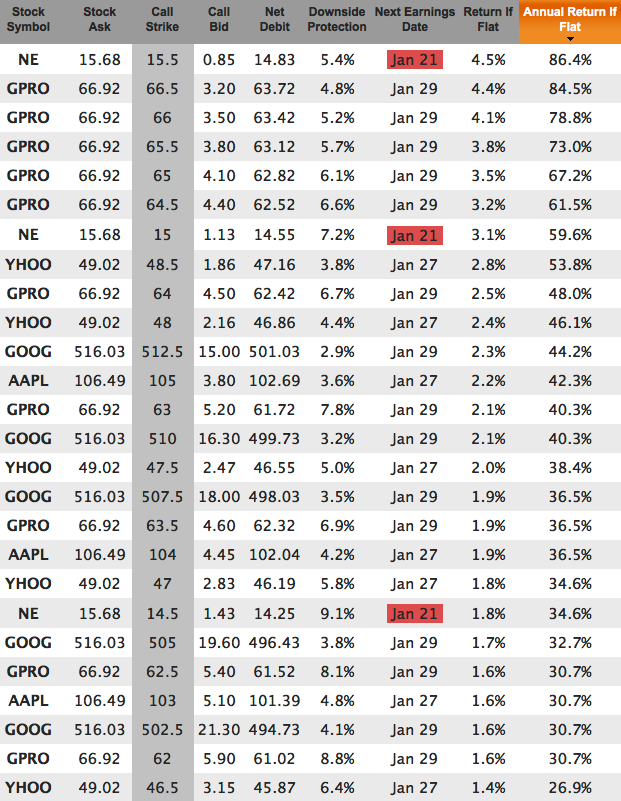

And if we go out to the weekly Jan 23 expiration (a 19-day trade), we find several opportunities with annualized return more than 25%, some of which have a downside protection over 8%:

The only anticipated earnings release date is Jan 21 for NE (which could be a reason not to choose NE for the Jan 23 expiration). There are no ex-dividend dates before the Jan 23 expiration.

Note: These are not trade recommendations. These are candidate trades based on the experts' picks for the best stocks to buy in 2015. Do your own research, keep position sizes modest, and stay diversified.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.